Loan modification breaches can lead to devastating financial and emotional consequences for homeowners. These breaches occur when lenders fail to honor agreements, mishandle applications, or violate federal guidelines. Common issues include wrongful denials, dual tracking (foreclosure during modification review), and document mismanagement. High-profile cases, such as Wells Fargo‘s $40 million settlement, highlight systemic problems like software errors and unfair practices.

Key takeaways:

- Wells Fargo’s errors: Impacted over 1,000 borrowers due to faulty software, leading to wrongful denials and foreclosures.

- Dual tracking risks: Homeowners can lose their homes if lenders pursue foreclosure during modification reviews.

- Document issues: Lost or rejected paperwork frequently disrupts the process.

- Legal recourse: Courts have awarded millions in damages, holding lenders accountable for breaches.

If you’re facing a loan modification breach, act quickly, keep detailed records, and seek legal help to protect your home and rights.

Nowlin v. Nationstar Mortgage, LLC (2016) Overview | LSData Case Brief Video Summary

Major Legal Cases on Loan Modification Breaches

Major Loan Modification Breach Cases and Settlement Amounts

Wells Fargo Loan Modification Class Action Lawsuit

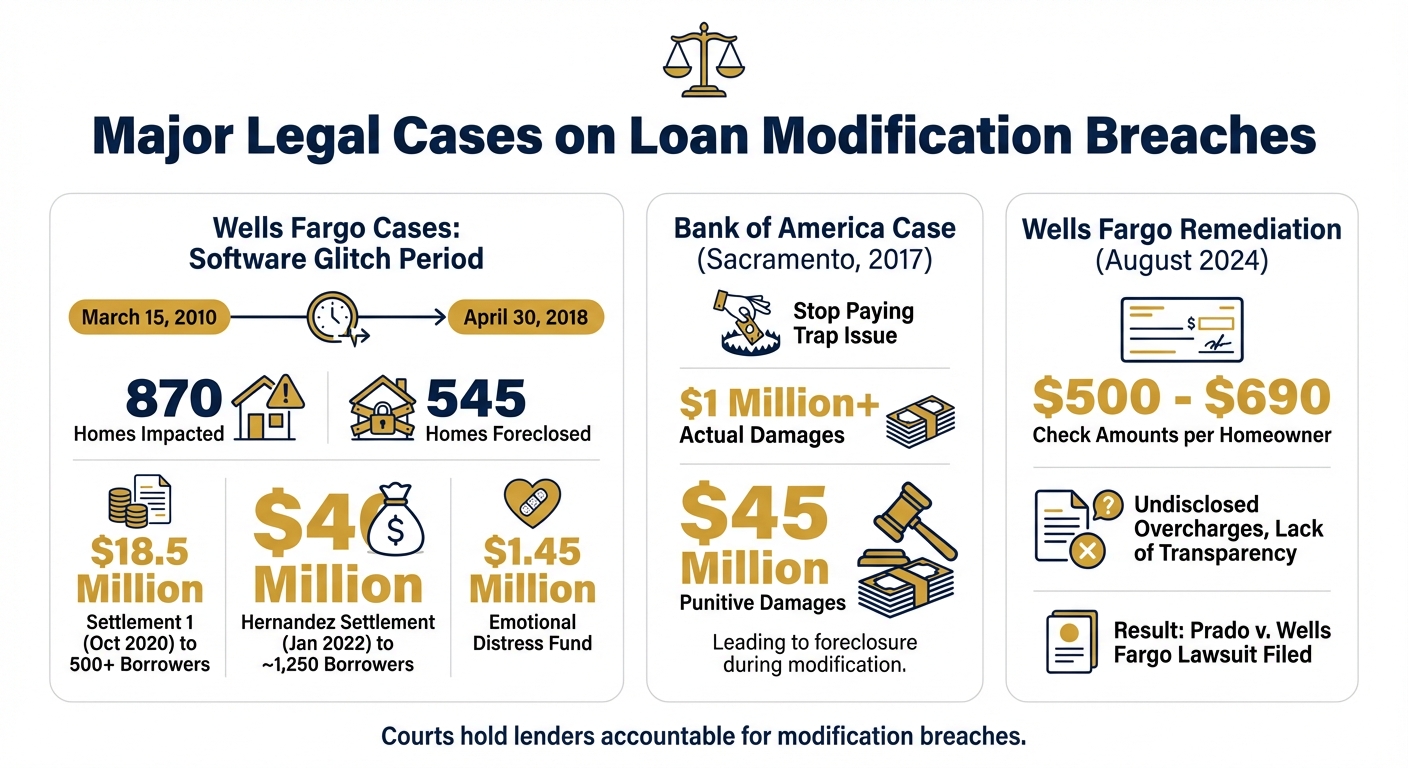

Between March 15, 2010, and April 30, 2018, a software glitch in Wells Fargo’s system wrongly denied homeowners access to HAMP loan modifications. This error impacted 870 homes in foreclosure, with 545 of them ultimately foreclosed upon – despite the fact that loan modifications should have been offered. Although Wells Fargo discovered the error in 2015, the company did not disclose it publicly until nearly three years later.

These failures sparked significant legal battles. Among the outcomes was an $18.5 million settlement approved in October 2020, providing relief to over 500 borrowers. Another major case, the Hernandez settlement, awarded over $40 million to approximately 1,250 borrowers in January 2022. This case addressed issues like miscalculated attorneys’ fees that affected HAMP eligibility. U.S. Senators Elizabeth Warren and Brian Schatz criticized Wells Fargo’s response, calling it wholly inadequate.

The Hernandez settlement also included a $1.45 million fund specifically for homeowners who experienced severe emotional distress. To receive compensation, affected individuals had to provide documented evidence to a court-appointed Special Master for review.

Common Patterns and Lessons from These Cases

Errors in automated systems often result in wrongful denials of loan modifications. A notable example is Wells Fargo, where software glitches have repeatedly caused qualified borrowers to be denied modifications. Many lenders fail to maintain their systems properly, leading to mistakes that prevent eligible homeowners from accessing trial modifications under programs like HAMP. But it’s not just faulty algorithms – lenders also use questionable practices that make life even harder for struggling homeowners.

The "stop paying" trap is a recurring issue. Some lenders suggest homeowners stop making mortgage payments to qualify for a modification. While the application is still "pending", they proceed with foreclosure. In one 2017 case involving Bank of America in Sacramento, this tactic led to a judge awarding over $1 million in actual damages and $45 million in punitive damages after homeowners lost multiple opportunities for modification.

Document mismanagement is another common obstacle. Lenders often claim they never received paperwork, repeatedly ask for the same documents, or reject previously submitted materials as "stale". This disorganization can lead to wrongful denials of modifications. To safeguard against this, homeowners should always send documents via certified mail with delivery confirmation and keep meticulous records of every submission.

Undisclosed overcharges have also become a growing concern. In August 2024, Wells Fargo issued remediation checks between $500 and $690 without providing a detailed breakdown of the errors. This lack of transparency sparked the Prado v. Wells Fargo lawsuit in the Northern District of California. Homeowners should avoid cashing such checks without first demanding a full explanation of how their account was impacted.

Double-check all signatures on modification agreements. Missing or incomplete signatures, much like mishandled paperwork, can increase the risk of foreclosure. Homeowners should ensure all parties sign the agreement and continue making trial payments, even if the lender delays returning a signed copy. In Chavez v. Indymac Mortgage Services (September 2013), the court blocked foreclosure when homeowners fulfilled their trial modification obligations despite delays on the lender’s side.

sbb-itb-d613a70

How Foreclosure Defense Group Protects Homeowners

When lenders fail to honor loan modification agreements, homeowners need a legal team that fights for their rights. Foreclosure Defense Group steps in to address these common lender practices and ensure fair treatment.

The firm’s attorneys dig deep into issues like automated calculation errors that wrongly deny trial modifications and dual tracking, where lenders proceed with foreclosure even when a modification application is pending or during active bankruptcy stays. These investigations lay the groundwork for strong legal strategies.

Beyond identifying errors, the firm leverages state consumer protection laws, such as the Illinois Consumer Fraud and Deceptive Business Practices Act (ICFA), to hold lenders accountable for unfair or deceptive actions during the modification process. These laws offer tools to address more than just contract breaches, providing homeowners with additional legal options.

To tackle these challenges, Foreclosure Defense Group offers free consultations to uncover hidden bank errors and patterns of misconduct. The California Supreme Court’s decision in Sheen v. Wells Fargo underscores the importance of professional legal defense, as it ruled that lenders have no duty of care in modification requests.

Each homeowner’s case is treated individually, with tailored defense plans designed to address issues like document mismanagement, wrongful denials, and undisclosed overcharges. The firm’s services include foreclosure defense, bankruptcy assistance, and resolving loan modification disputes – all aimed at protecting homeowners’ rights and preventing foreclosure.

Conclusion: Protecting Your Home and Legal Rights

The examples shared above highlight a troubling pattern where lenders fail to honor loan modification agreements, putting homeowners’ rights at risk. High-profile cases like Wells Fargo’s multi-million-dollar settlement and Bank of America’s ruling – resulting in over $1 million in actual damages and $45 million in punitive damages – show that courts are willing to hold lenders accountable for their actions.

Taking action quickly is essential. Prompt legal intervention can stop foreclosures, prevent additional fees from piling up, and reverse harmful financial practices. Delaying until after a foreclosure sale makes it much harder to undo the damage.

Keep detailed records of every interaction with your lender. Claims of “lost” or “incomplete” applications are often used as excuses for denials. Ensure that lenders respect automatic stays during bankruptcy and challenge any demands that fall outside the terms of your modification agreement.

These cases emphasize the importance of assertive legal action in protecting your home. Courts have required lenders to send signed Modification Agreements once borrowers meet their obligations, and laws like the California Homeowner Bill of Rights ban practices such as "dual tracking", where lenders proceed with foreclosure while a modification application is under review. With experienced legal guidance, these violations can be identified, and strong cases can be built to hold lenders accountable.

If your lender has breached a modification agreement, don’t wait – pursue legal action immediately. The outcomes of these cases demonstrate that skilled representation and decisive action can safeguard your home and financial wellbeing. Foreclosure Defense Group is prepared to offer personalized legal strategies to protect your rights. They provide free consultations to uncover lender errors and develop effective solutions to ensure lenders honor their commitments.

FAQs

What can I do if my lender is foreclosing while my loan modification is still under review?

If your lender is pushing ahead with foreclosure while your loan modification is still under review, you need to act fast. This practice, known as dual-tracking, is illegal under federal laws like the Real Estate Settlement Procedures Act (RESPA) and state laws such as California’s Homeowner Bill of Rights.

Start by gathering all the paperwork that confirms your loan modification is still being reviewed. Then, consult an attorney without delay. Courts have previously ruled against lenders for breaking dual-tracking laws, and you might be able to halt the foreclosure with a preliminary injunction. In some cases, it’s even possible to reverse a completed foreclosure if the lender didn’t follow proper procedures.

A skilled foreclosure defense attorney, such as those at Foreclosure Defense Group, can guide you through this process. They can assist with filing motions, negotiating with your lender, and safeguarding your rights. Taking swift action can greatly improve your chances of keeping your home and securing the loan modification you’re entitled to.

How can I prove emotional distress caused by a lender’s failure to honor a loan modification?

To demonstrate emotional distress caused by a lender’s failure to honor a loan modification, you’ll need to provide solid evidence that connects their actions to your mental health struggles. Start by saving all relevant communication, like letters, emails, or phone call records, that highlight the lender’s mishandling of your loan modification. Medical records, such as diagnoses or therapist notes, can help show how the stress affected your mental well-being. You might also consider using personal journals to document your experiences, along with statements from family, friends, or coworkers who observed the emotional toll.

Bringing in a mental health expert to testify about the extent of your distress and its financial impact – like therapy expenses or lost income – can further strengthen your case. Be aware that the ability to recover damages for emotional distress can vary depending on your state, as some have stricter limitations on these claims. For tailored advice and legal assistance, Foreclosure Defense Group can help you collect evidence, document your damages, and safeguard your rights.

How can I make sure my loan modification documents are handled correctly by my lender?

To make sure your loan modification paperwork is handled correctly, here’s what you should do:

- Complete your application thoroughly: Double-check that every form is fully filled out, signed, and includes all necessary documents, such as pay stubs, tax returns, and hardship letters. Missing information is one of the most common reasons applications get denied.

- Request written acknowledgment: Ask your lender for a dated confirmation that they’ve received your application. Keep this acknowledgment in your records – it’s an important piece of documentation.

- Stay on top of things: Keep copies of everything you submit and track key deadlines. Regularly follow up with your lender to ensure your application is still being reviewed and document every interaction for your records.

If you run into delays, mistakes, or feel your application has been unfairly denied, reaching out to a foreclosure defense attorney can help safeguard your rights. Staying organized and proactive can significantly improve your chances of securing a loan modification.

Related Blog Posts

- Loan Modification Document Checklist

- How Attorneys Help Resolve Mortgage Disputes

- How Loan Modifications Affect Credit Scores

- Government Loan Modifications: Solving Foreclosure Risks