Foreclosure can lead to losing your home, damaging your credit, and incurring extra costs. If you’re struggling with mortgage payments, here are five government programs that can help:

- Homeowner Assistance Fund (HAF): Offers financial aid for mortgage payments, property taxes, and utilities. Available until September 30, 2026, or until funds run out.

- FHA Loss Mitigation Programs: For FHA-insured loans, options include loan modifications, repayment plans, and temporary forbearance.

- HUD-Approved Housing Counseling: Free counseling to navigate financial challenges and negotiate with lenders.

- Making Home Affordable (MHA): Although expired, its framework influences current programs like Flex Modifications.

- Hardest Hit Fund (HHF): Provided state-specific aid during the housing crisis. Officially ended in 2023 but inspired ongoing efforts.

Act quickly. Contact your servicer or a HUD-approved counselor to explore your options. Early action opens more opportunities to save your home.

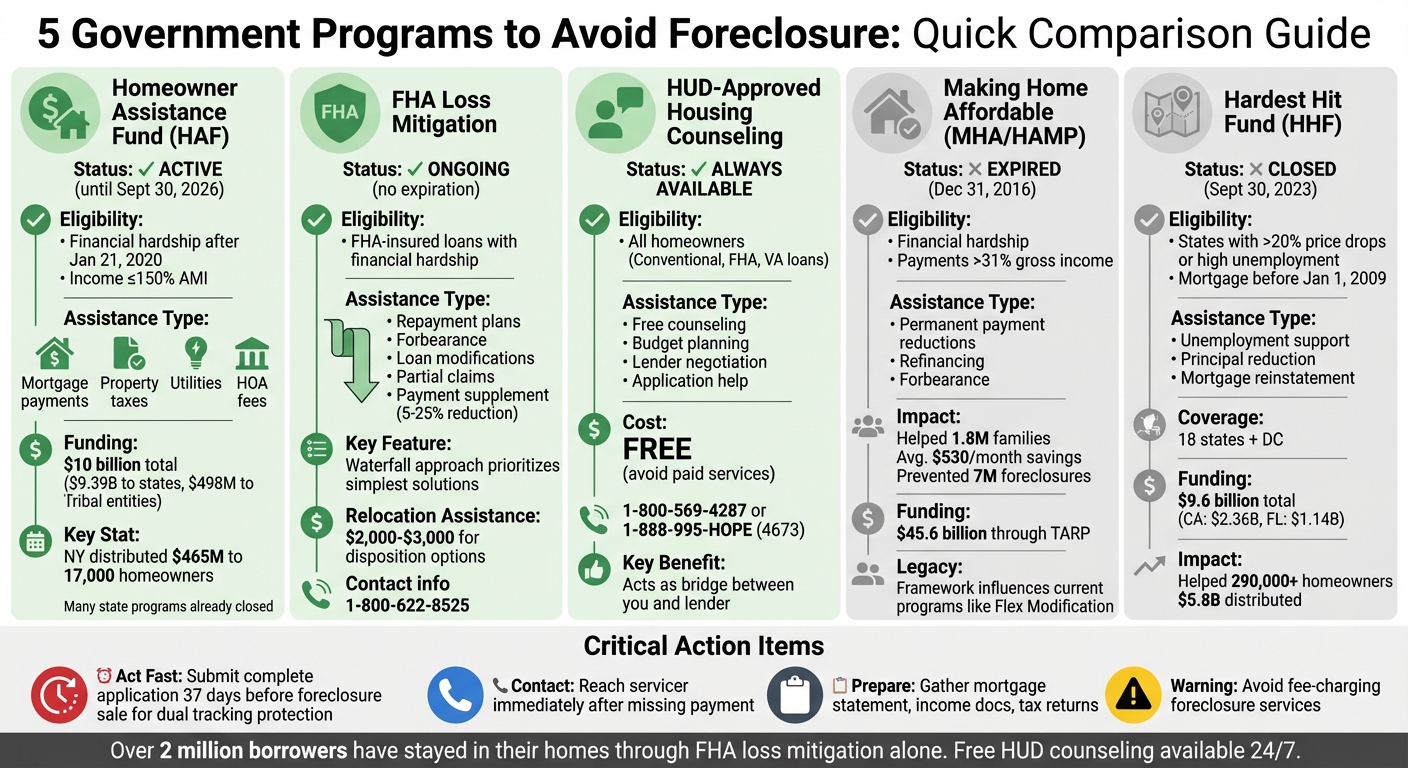

5 Government Foreclosure Prevention Programs Comparison Chart

Are There Government Foreclosure Prevention Programs? – CountyOffice.org

1. Homeowner Assistance Fund (HAF)

The Homeowner Assistance Fund (HAF), created as part of the American Rescue Plan Act of 2021, provides nearly $10 billion to help homeowners impacted by COVID-19. Its goal is to prevent issues like delinquencies, defaults, foreclosures, and utility shutoffs. Of this funding, $9.39 billion was allocated to states, while $498 million went to Tribal entities.

HAF offers support for much more than just mortgage payments. Eligible expenses include mortgage reinstatement, principal reduction, property taxes, homeowner’s insurance, HOA fees, and utility bills (covering electricity, gas, water, and internet services). The good news? Any assistance you receive for mortgage or utility payments is not taxable income. Funds are available until September 30, 2026.

To qualify, you must have experienced financial hardship after January 21, 2020, and your household income must be at or below 150% of the Area Median Income (AMI) or the national median, whichever is higher. At least 60% of the funding is reserved for homeowners earning less than 100% of the AMI. For example, in New York State, HAF provided assistance to nearly 17,000 homeowners, distributing $465 million in awards and enabling affordable loan modifications for 2,800 homeowners.

To apply, visit your state or Tribal housing agency’s website. You’ll need to submit an attestation of financial hardship, explain your situation, and provide income verification (such as pay stubs or tax records). If you’re missing any required documents, some states may offer waivers.

Be aware that many state HAF programs have already closed or run out of funds. In New York State, for instance, the program ended in early 2026 after fully distributing its funds. To check your state’s program status, visit their website. If your state’s program has closed, reach out to a HUD-approved housing counselor for foreclosure prevention options. Up next, we’ll dive into FHA Loss Mitigation Programs to explore additional resources for struggling homeowners.

2. FHA Loss Mitigation Programs

FHA-insured mortgages require servicers to collaborate with borrowers to help avoid foreclosure. These programs offer two main paths: home retention options to help you stay in your home and disposition options for a smoother exit. As HUD explains:

"Lenders do not want your house. They have options to help borrowers through difficult financial times".

Your servicer will assess your situation using a "waterfall" approach, which prioritizes the simplest solutions first. For home retention, options include:

- Repayment plans: Spread overdue payments across future monthly installments.

- Forbearances: Temporarily reduce or pause payments.

- Standalone partial claims: An interest-free second lien for up to 30% of your unpaid principal balance, repayable only when you sell or refinance.

- Loan modifications: Permanently adjust your interest rate or extend your loan term.

A newer option, the Payment Supplement, can lower your monthly principal and interest payments by 5% to 25% for three years without changing the terms of your original loan .

Eligibility and Next Steps

To qualify for these programs, you must have an FHA-insured loan, be facing financial hardship, and either be in default or at imminent risk of default. If you’re struggling with payments, contact your servicer immediately and provide updated financial records. You may also need to complete a Trial Payment Plan (TPP) before final approval. Keep in mind that you’re generally limited to one permanent loss mitigation option every 24 months, unless you’re impacted by a Presidentially Declared Major Disaster .

When Retention Isn’t an Option

If keeping your home isn’t feasible, FHA also offers pre-foreclosure sales (short sales) and deed-in-lieu of foreclosure options. These programs can help you transition out of your home, and you may qualify for relocation assistance ranging from $2,000 to $3,000 upon completion.

If your servicer isn’t cooperating, call the FHA’s National Servicing Center at 1-800-622-8525 for support. You can also reach out to a HUD-approved housing counselor for free foreclosure prevention assistance. Remember, these counselors provide their services at no cost, so avoid paying private companies for help that’s already available for free.

3. HUD-Approved Housing Counseling

When homeowners face the risk of foreclosure, government programs like HUD-approved housing counseling can provide essential support. These programs connect you with certified counselors who specialize in guiding homeowners through financial challenges. According to the Consumer Financial Protection Bureau:

"A housing counselor through a HUD-approved agency is specially trained and certified by the government to help you assess your financial situation, evaluate options if you are having trouble paying your mortgage loan, and make a plan to get you help with your mortgage."

These counselors do more than just offer advice – they act as a bridge between you and your lender. They can help you review your financial documents, create an emergency budget, and prepare and submit loss mitigation applications. They also explain your state’s foreclosure process and provide tips to avoid scams that may charge unnecessary fees.

Getting started is straightforward. You can find a HUD-approved counselor online or call 1-800-569-4287. For round-the-clock assistance, dial 1-888-995-HOPE (4673). It’s crucial to reach out as early as possible, as acting quickly can open up more options for resolving your situation.

The best part? HUD-approved foreclosure counseling is free. Be cautious of any service asking for upfront fees. To make the process smoother, have your latest mortgage statement and financial documents ready before your counseling session.

sbb-itb-d613a70

4. Making Home Affordable Program

The Making Home Affordable (MHA) program was a federal effort designed to support homeowners facing financial difficulties during the housing crisis. Although the program officially ended on December 31, 2016, its framework continues to influence many of today’s foreclosure prevention strategies.

At its height, MHA had a significant impact, assisting over 1.8 million families through the Home Affordable Modification Program (HAMP). This initiative helped reduce monthly mortgage payments by an average of more than $530. Additionally, the program’s standards helped over 7 million Americans avoid foreclosure altogether.

MHA offered a range of solutions, including permanent payment reductions through HAMP, refinancing options for homeowners with underwater mortgages, temporary forbearance for those unemployed, and alternatives to foreclosure. One key feature was ensuring that modified payments did not exceed 31% of a homeowner’s gross monthly income.

While MHA is no longer available, homeowners may find similar assistance through their mortgage servicers. Many lenders now offer updated programs inspired by MHA, such as the "Flex Modification" program, which replaced HAMP and incorporates key lessons from its predecessor. If you’re seeking help, contact your lender directly to discuss current options. Be prepared with essential documents like income statements, recent tax returns, and details about your outstanding debts.

The U.S. Treasury allocated up to $45.6 billion for MHA through the Troubled Asset Relief Program (TARP), setting the foundation for many of the standards lenders still follow today when modifying mortgages.

Next, we’ll take a look at the Hardest Hit Fund programs, which provide additional support for homeowners in need.

5. Hardest Hit Fund Programs

The Hardest Hit Fund (HHF) was created in February 2010 as part of the Troubled Asset Relief Program (TARP) to help homeowners in states hit hardest by the housing crisis. According to the U.S. Department of the Treasury, HHF provided funding to state Housing Finance Agencies (HFAs) so they could develop foreclosure prevention programs tailored to areas suffering from sharp home price drops and high unemployment rates. States qualified for this assistance if their home prices had fallen by more than 20% or their unemployment rates were at or above the national average.

Initially, the program launched with $1.5 billion across five states, but it eventually expanded to $9.6 billion, covering 18 states and the District of Columbia. By December 2016, the program had helped over 290,000 homeowners, with participating states using about $5.8 billion of the allocated funds. California received the largest share, $2.36 billion, followed by Florida with $1.14 billion. The flexibility of these funds allowed each state to design programs that addressed their unique foreclosure challenges.

Through their Housing Finance Agencies, states developed various programs to help homeowners. These included assistance with mortgage payments for those who were unemployed, principal reductions to lower loan balances, mortgage reinstatement to cover overdue payments, and even efforts to eliminate blight and stabilize neighborhoods. To qualify for HHF assistance, homeowners generally needed to have a mortgage originated on or before January 1, 2009, and a monthly mortgage payment exceeding 31% of their gross income.

The program’s spending deadline was December 31, 2020, and all TARP housing programs officially ended on September 30, 2023. While HHF is no longer active, homeowners can still reach out to their state’s Housing Finance Agency to explore any new or ongoing programs that may carry forward similar goals.

If you’re a homeowner facing foreclosure, contact your mortgage servicer or a HUD-approved housing counselor for help. Be cautious of foreclosure recovery services that charge fees – legitimate housing counseling services are always free.

Program Comparison Table

Here’s a quick look at foreclosure prevention programs, comparing their eligibility criteria, assistance types, and deadlines.

| Program | Eligibility Rules | Type of Financial Assistance | Application Deadline |

|---|---|---|---|

| Homeowner Assistance Fund (HAF) | Homeowners facing financial hardship due to the COVID‑19 pandemic. | Direct financial aid to cover mortgage payments and related housing costs. | September 30, 2026, or until state funds run out. |

| FHA Loss Mitigation | Homeowners with FHA‑insured loans experiencing hardship or unemployment. | Options like loan modifications, forbearance, repayment plans, and partial claims. | No expiration date; ongoing. |

| HUD‑Approved Counseling | Open to all homeowners, including those with Conventional, FHA, and VA loans. | Free or low-cost advice, budget counseling, and lender negotiation support. | Available anytime. |

| Making Home Affordable (HAMP) | Homeowners with documented financial hardship who can meet modified payments. | Permanent loan modifications, such as interest rate reductions, principal reductions, or term extensions. | Expired December 30, 2016. |

| Hardest Hit Fund (HHF) | State-specific programs for areas with high unemployment or significant home value declines. | Assistance like unemployment support and principal reductions. | Closed as of September 30, 2023. |

This table highlights essential details about each program. The Homeowner Assistance Fund (HAF) provides direct financial help, but availability depends on your state. FHA Loss Mitigation is an ongoing option for those with FHA-insured loans, offering flexible solutions without a deadline. HUD-Approved Counseling is always accessible and can guide you through these programs while assisting with lender negotiations.

Keep in mind that some programs, such as HAMP and HHF, are no longer active. If you’re struggling with mortgage payments, reach out to your mortgage servicer or your state’s Housing Finance Agency to explore current solutions.

Conclusion

Government foreclosure prevention programs provide practical solutions for homeowners facing financial challenges. Through FHA loss mitigation options alone, over 2 million borrowers have been able to stay in their homes. Whether you’re looking for temporary relief like forbearance, permanent adjustments through loan modifications, or free advice from HUD-approved counselors, these programs offer structured options to help you navigate tough times.

Timing is critical. Federal law requires your mortgage servicer to pause foreclosure proceedings if you submit a complete loss mitigation application at least 37 days before a foreclosure sale. This safeguard, often referred to as "dual tracking" protection, gives you time to work on a resolution – but only if you act quickly. Contact your servicer as soon as you miss a payment to explore early intervention options.

Expert guidance makes a difference. HUD-approved housing counselors are available to provide free support. For more complex issues – such as bankruptcy, wrongful foreclosure, or legal defenses – professionals like Foreclosure Defense Group can offer the expertise needed to protect your rights. Combining these government programs with professional assistance strengthens your ability to defend against foreclosure effectively.

"If you are in a foreclosure court case, you should consult an attorney." – New York State Department of Financial Services

Don’t delay. Start gathering your financial documents and reach out to your servicer or a HUD-approved counselor today. With the right mix of programs and expert support, you can find a path forward that helps you keep your home.

FAQs

How can I apply for the Homeowner Assistance Fund (HAF)?

The Homeowner Assistance Fund (HAF) is a federal initiative aimed at supporting homeowners facing financial challenges, including those stemming from the COVID-19 pandemic. To get started, confirm your eligibility. This often involves demonstrating issues like overdue mortgage payments, utility bills, or a documented financial hardship.

Once you’re sure you qualify, head to your state’s housing agency website to find your state’s HAF program. Keep in mind, applications are only accepted while funds are available, and the program wraps up in September 2026 or sooner if funds run out.

Before applying, gather the required documents. These typically include proof of mortgage, utility bills, and evidence of your financial hardship. Submit your application through your state’s HAF website. If the process feels overwhelming or you’re unsure about eligibility requirements, the Foreclosure Defense Group can guide you through it, helping you compile documents and ensuring your submission is accurate.

Who is eligible for FHA Loss Mitigation Programs?

To qualify for FHA loss mitigation programs, you need to have an FHA-insured mortgage and be experiencing financial difficulties that affect your ability to make timely payments. Eligibility depends on several factors, including your income, whether you can handle a modified payment, your commitment to keeping the home, and how serious your financial challenges are.

These programs aim to support homeowners who are looking to avoid foreclosure and remain in their homes, as long as they meet the required conditions.

Can I still get assistance if the Hardest Hit Fund is no longer available?

Unfortunately, the Hardest Hit Fund stopped offering assistance as of March 31, 2022. But don’t worry – there are still options out there to help homeowners who are struggling. One key resource is the Homeowner Assistance Fund, which provides financial relief for those having trouble keeping up with mortgage payments or other housing expenses.

If foreclosure feels like it’s looming, it’s worth looking into legal and financial options that fit your unique situation. Solutions like loan modifications or forbearance agreements can help you manage your finances and work toward keeping your home.

Related Blog Posts

- Top 4 Mortgage Relief Programs in Florida for 2025

- Government Loan Modifications: Solving Foreclosure Risks

- Checklist: FHA Foreclosure Relief Eligibility

- California Mortgage Relief Program Overview