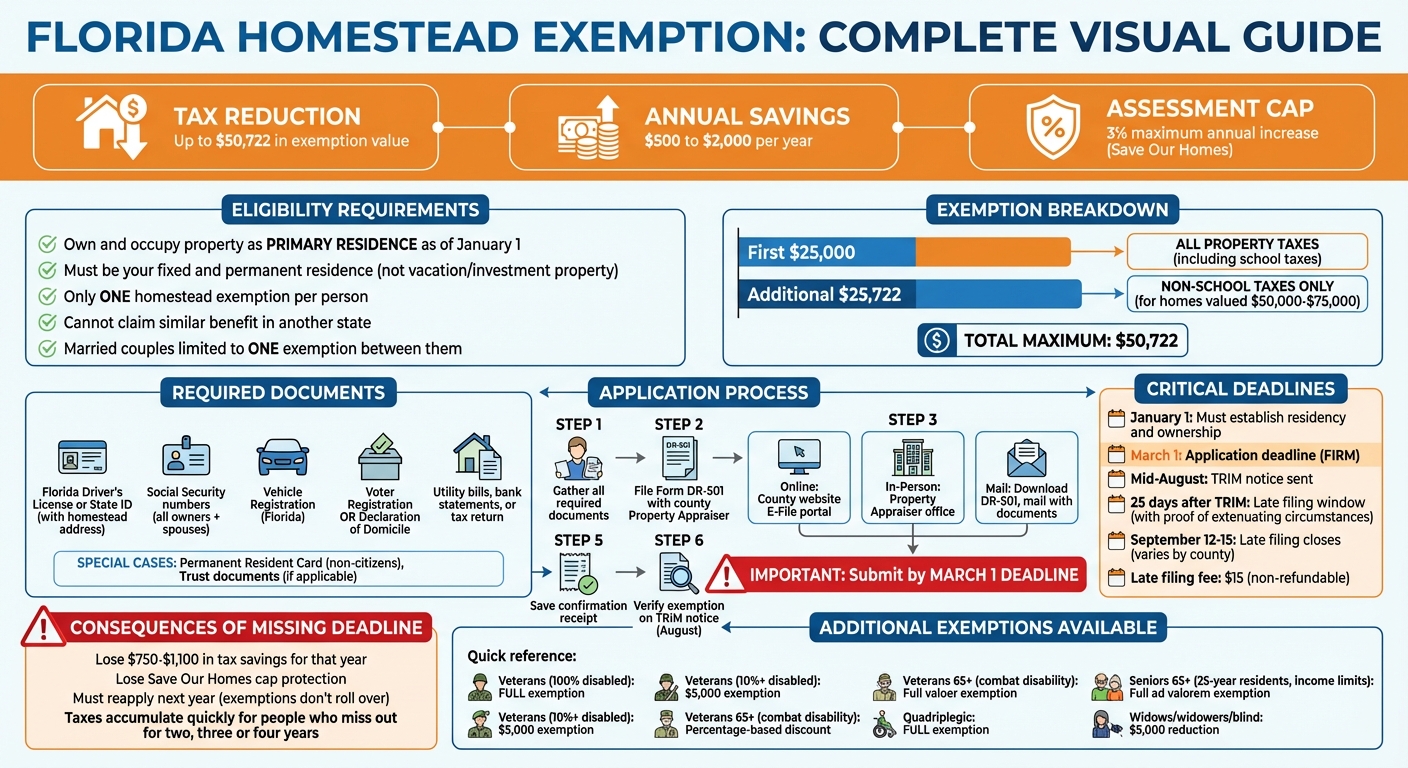

The Florida Homestead Exemption reduces property taxes for homeowners who declare their residence as their permanent home. For the 2026 tax year, it can lower your taxable value by up to $50,722, potentially saving you $500 to $2,000 annually. Here’s what you need to know:

- Eligibility: You must own and occupy the property as your primary residence as of January 1. Proof of residency (e.g., Florida ID, voter registration, utility bills) is required.

- Exemption Breakdown: The first $25,000 applies to all property taxes, including school taxes. The additional $25,722 applies to non-school taxes for homes valued between $50,000 and $75,000.

- Save Our Homes Cap: Limits annual increases in assessed value to 3% or the Consumer Price Index (CPI), protecting against sudden tax hikes.

- Application Deadline: File Form DR-501 with your county’s Property Appraiser by March 1. Late filing may be allowed under specific circumstances, but you risk losing the exemption for the year.

- Key Documents: Florida ID, Social Security numbers, proof of residency, and any additional paperwork for special cases (e.g., trusts, non-citizens).

Missing the deadline could result in losing tax savings and the benefits of the assessment cap. Visit your county’s Property Appraiser website or office to apply on time.

Florida Homestead Exemption Application Process and Requirements

How to File for Homestead Exemption in Florida (Quick & Easy Tutorial)

Who Qualifies for the Florida Homestead Exemption

To qualify for the Florida Homestead Exemption, you need to meet specific residency and ownership requirements as of January 1 of the tax year.

Primary Residence Requirements

Your home must be your fixed and permanent residence as of January 1 – it cannot be a vacation home or an investment property. According to the Property Appraiser, "By law, January 1 of each year is the date on which permanent residence is determined."

To prove your residency, you’ll need documentation. Acceptable forms include:

- A valid Florida driver’s license or ID

- Vehicle registration

- Voter registration

- Utility bills

- Bank statements

- Your latest IRS tax return

- A recorded Declaration of Domicile

Although there’s no requirement to live in the home for a specific number of months each year, renting out the property for extended periods could affect your eligibility.

Once your residency is established, you’ll need to confirm you meet the ownership requirements outlined below.

Property Ownership and Exemption Limits

You must hold legal or beneficial title to the property as of January 1. Ownership can be in your name individually, jointly, by the entireties, or in common with others. If the property is held in a trust, you may still qualify, but you’ll likely need to provide a copy of the trust or a Certificate of Trust to the property appraiser.

Florida allows only one homestead exemption per person. You cannot claim a similar residency-based tax benefit in another state or county while applying for Florida’s exemption. For example, if you’re relocating from another state, you must cancel any comparable benefits, such as New York’s STAR program or Massachusetts’ Declaration of Homestead, by January 1 of the application year.

Married couples are limited to one homestead exemption between them, even if they own multiple properties. Additionally, certain ownership types can also qualify, such as condominium units, tenant-stockholders in cooperative corporations with leases of 98 years or more, and mobile home owners, provided the property serves as their permanent residence.

Documents You Need to Apply

Getting your paperwork in order is key to avoiding delays when applying through the Florida property appraiser’s office. They require specific documentation to confirm your identity and residency.

ID and Proof of Residency

First, you’ll need Social Security numbers for all property owners and their spouses – even if your spouse isn’t on the deed. A valid Florida driver’s license or state ID that lists your homestead address is also required.

On top of that, you’ll need one or two additional proofs of residency. These can include:

- Florida vehicle registration

- Florida voter registration showing your homestead address

- A recorded Declaration of Domicile

- Utility bills for the property

- Bank statements sent to your homestead address

- Your most recent federal income tax return listing the property address

The appraiser might also ask for details such as your employer’s information or your children’s school enrollment. If your situation is unique, check the additional requirements below.

Additional Documents for Special Cases

If you’re not a U.S. citizen, you’ll need to provide a Permanent Resident Card or your immigration/resident alien number. For properties held in a trust, include the trust name as it appears on the deed. In some counties, you may also need to submit either the full trust agreement or a Certificate of Trust from the Property Appraiser’s Office.

Be aware that knowingly submitting false information is a serious offense. It’s classified as a first-degree misdemeanor and carries penalties of up to one year in prison and a $5,000 fine. Additionally, improperly claimed exemptions can result in a penalty of 50% of the unpaid taxes, plus 15% interest per year.

How to Submit Your Application

You’ll need to file your application through your county’s Property Appraiser’s office by the March 1 deadline. Florida does not provide a single statewide portal for this process.

Filing Online

Before you start, make sure you’ve gathered all the necessary documents mentioned earlier.

Most counties have an "E-File" or "Homestead Online" section on their Property Appraiser’s website. For example, Palm Beach County uses pbcpao.gov, while Pinellas County uses pcpao.gov. Once you’re on your county’s portal, locate your property by entering either the Property Control Number (PCN) or your physical address.

You’ll need to upload digital copies of the required documents through the online system. Additionally, you’ll be asked to provide Social Security numbers for all property owners and their spouses, along with birth dates and the date you began living in the property. After completing the electronic signature, save the confirmation receipt for your records.

"Disclosure of your social security number is mandatory. It is required by Section 196.011, Florida Statutes."

– Pinellas County Property Appraiser

If online filing doesn’t work for you, you can explore other options.

Filing in Person or by Mail

For those who prefer not to file online, in-person and mail-in options are available.

You can visit your county’s Property Appraiser office or a regional service center. Some offices may require an appointment, so it’s a good idea to check their website beforehand. Be sure to bring originals or certified copies of your Florida driver’s license, vehicle registration, and any other residency documents.

If you choose to mail your application, download and complete Form DR-501 from your county’s website. Include the required copies of your documents and send them to the mailing address listed on the site. Each county has its own address for submissions. For instance, in Duval County, you’ll receive a receipt by mail within 45 days as proof of filing. If you don’t get a confirmation, you can verify your exemption status using the "Property Search" feature on your county’s website under the "Taxable Values and Exemptions" section.

sbb-itb-d613a70

Application Deadlines and Late Filing

To claim your Homestead Exemption, make sure to file by March 1. Missing this deadline under Florida law means losing your exemption for that tax year, which could cost you significant savings. These savings include a property tax reduction of up to $50,000 and the benefits of the "Save Our Homes" assessment cap, which limits how much your property’s taxable value can increase each year.

"Taxes accumulate quickly for people who miss out for two, three or four years. The good thing is that it’s free. They don’t have to pay to file."

- Marilyn Martinez, Hillsborough County Property Appraiser’s Office

What Happens If You Miss the Deadline

Missing the March 1 deadline can result in losing $750 to $1,100 in tax savings for that year. Keep in mind, exemptions don’t roll over – you’ll need to reapply the following year.

That said, there are limited circumstances where late filing might still be an option.

When Late Applications Are Accepted

If you miss the March 1 deadline, Florida allows for late filing under specific conditions. After receiving your TRIM (Truth in Millage) notice – typically sent out in mid-August – you have 25 days to submit a late application. This window usually closes in early to mid-September, often around September 12 or 15, depending on your county.

To file late, you’ll need to provide proof of extenuating circumstances. The final decision rests with your local Property Appraiser or the Value Adjustment Board (VAB). Filing a late petition with the VAB typically involves a $15 non-refundable fee, and some counties, like Palm Beach, require in-person submissions instead of online applications. After this period, no further late filings are allowed, as stated in Florida Statute Sec. 196.011.

Other Property Tax Exemptions and Legal Help

Other Exemptions Available in Florida

In addition to the standard homestead exemption, Florida provides a variety of specialized property tax relief options. For example, veterans with a service-connected, total, and permanent disability are completely exempt from paying property taxes on their homestead. Veterans who have a VA-certified service-connected disability of 10% or more, as well as their unremarried surviving spouses, can qualify for a $5,000 exemption.

Veterans aged 65 or older who have a combat-related disability may receive a discount on their property taxes, calculated based on their disability percentage. Surviving spouses of military members who passed away due to service-connected causes are also fully exempt from property taxes.

Tax relief isn’t limited to veterans. Quadriplegic individuals are eligible for a full exemption, while those who are paraplegic, hemiplegic, legally blind, or wheelchair-dependent may qualify for an exemption, provided their household income falls within certain limits. Seniors aged 65 or older with limited incomes who have been Florida residents for at least 25 years might even eliminate ad valorem taxes entirely. Additionally, widows, widowers, and blind individuals can benefit from a $5,000 reduction in assessed property value.

To confirm eligibility, income limits, and required documentation, it’s essential to contact your county property appraiser. Veterans will typically need VA-certified documentation of their disability, and most exemptions require that you hold legal title to the property and have been a permanent Florida resident as of January 1 of the tax year.

Legal Assistance from Foreclosure Defense Group

When property tax issues put your financial situation at risk, having professional legal support can make all the difference.

If you’re struggling with property taxes or facing foreclosure, Foreclosure Defense Group offers skilled legal assistance to help safeguard your rights. Their services include foreclosure defense, bankruptcy guidance, loan modification and forbearance options, as well as deed-in-lieu and short sale negotiations – all aimed at helping homeowners manage financial hardships.

Foreclosure Defense Group provides free consultations to assess your situation and discuss potential solutions. Led by Austin N. Aaronson, Esq., the firm offers tailored support to address your unique circumstances, whether you need help understanding exemptions, challenging foreclosure proceedings, or restructuring your mortgage. For more details or to schedule a consultation, visit foreclosuredefensegroup.com.

Conclusion

Meeting Florida’s Homestead Exemption requirements is key to reducing your property taxes and securing long-term savings.

To qualify, you must own and occupy your home as your primary residence on January 1. Make sure your Florida driver’s license, vehicle registration, and Social Security numbers are up to date. Then, submit Form DR-501 by March 1. Missing this deadline means forfeiting the exemption for that tax year, which could cost you between $500 and $2,000 in savings. It also prevents you from benefiting from the "Save Our Homes" cap, which limits annual property assessment increases to 3%.

"Taxes accumulate quickly for people who miss out for two, three or four years".

If you miss the March 1 deadline, Marilyn Martinez advises contacting your property appraiser immediately to file a late application. However, this must be done before the mid-August cutoff – after that, applications for the year are no longer accepted.

Once approved, your exemption usually renews automatically each year. Check your TRIM notice each August to ensure it’s listed correctly. If your circumstances change – such as renting out the property or moving – notify your property appraiser by March 1 to avoid penalties.

If you face challenges with your exemption or are at risk of foreclosure, the Foreclosure Defense Group offers free consultations and expert guidance to help protect your home. Whether you need foreclosure defense or loan modification support, their experienced team can assist. Visit foreclosuredefensegroup.com to schedule a consultation.

FAQs

Can I lose my Florida Homestead Exemption if I rent out my property?

Renting out your homestead property can put your homestead exemption at risk. If the property is fully or mostly rented out for over 30 days in a calendar year for two consecutive years, it may be seen as abandoning the exemption.

That said, renting out just part of your home – like a single room – usually doesn’t impact your exemption. Still, it’s crucial to consult your local county for specific rules and regulations. Staying informed and following local guidelines is key to keeping your exemption intact.

Can I still apply for the Florida Homestead Exemption if my property is in a trust?

Yes, you can apply for the Florida Homestead Exemption even if your property is held in a trust, provided certain conditions are met. Specifically, you must have a beneficial or equitable title as a trust beneficiary and a present possessory interest in the property. Additionally, the deed transferring the property into the trust must be properly recorded.

If you’re uncertain about your eligibility or need guidance, reaching out to a legal professional can help ensure your application complies with all requirements.

What happens if I provide false information on my homestead exemption application?

Providing incorrect details on your Florida Homestead Exemption application can have serious repercussions. You might be hit with homestead tax liens and forced to repay every dollar saved from the exemption during the violation period. On top of that, Florida law permits legal penalties, which could include fines or other consequences. Double-check your application for accuracy to steer clear of these problems.

Related Blog Posts

- 7 Legal Rights Every Florida Homeowner Should Know

- 3 Ways to Stop Foreclosure in Florida

- Top 4 Mortgage Relief Programs in Florida for 2025

- Short Sale Document Requirements Explained