If you’re struggling to keep up with your FHA mortgage payments, a loan modification can help by adjusting your loan terms to make payments more manageable. This process might involve lowering your interest rate, extending your loan term (up to 40 years), or temporarily reducing your monthly payments. The goal? To help you avoid foreclosure and stabilize your finances.

Key Points:

- Eligibility: Your mortgage must be FHA-insured, and the property must be your primary residence. Financial hardship, such as job loss, medical expenses, or natural disasters, is required.

- New Payment Supplement Option: Temporarily reduces your monthly payments by 5%-25% for up to three years without changing your original loan terms.

- Simplified Process: Recent updates mean less paperwork – focus is on verifying hardship and occupancy status.

- Steps to Apply: Review finances, contact your loan servicer, submit required documents, complete a trial payment plan, and finalize the modification.

Act quickly if you’re at risk of missing payments. Contact your loan servicer or a HUD-approved counselor for assistance.

Loan Modification – Do It Yourself! Mortgage Modification Application Explained.

sbb-itb-d613a70

Who Qualifies for an FHA Loan Modification

If you’re struggling to keep up with your mortgage payments, an FHA loan modification might be an option. However, qualifying for one involves meeting specific criteria laid out by the U.S. Department of Housing and Urban Development (HUD).

Basic Qualification Requirements

First and foremost, your mortgage must be FHA-insured, and the property in question must be your primary residence. Unfortunately, this means that investment properties or vacation homes won’t qualify for loan modifications aimed at keeping your home.

To be eligible, you must either be in default (behind on payments) or at risk of default due to a financial hardship. Importantly, all borrowers listed on the loan must agree to participate in the modification process.

"To qualify for any of the home retention options, you will need to provide your servicer with current information, and you may be required to agree to a trial payment plan (TPP) before you are approved." – FHA Resource Center

It’s worth noting that borrowers are generally limited to one permanent loss mitigation option every 24 months. An exception to this rule applies if you’ve been impacted by a Presidentially Declared Major Disaster.

Understanding these requirements is the first step before diving into the application process. Below, we’ll explore the types of financial hardships that can make you eligible.

Types of Financial Hardship That Qualify

FHA loan modifications are designed to assist borrowers facing serious financial challenges. Here are some of the qualifying hardships:

- Job Loss or Income Reduction: Losing your job, having your hours cut, or transitioning to a lower-paying role can qualify.

- Medical Expenses: Unexpected hospital bills or long-term medical conditions that strain your finances are also considered.

- Death of a Co-Borrower or Spouse: Losing a household income contributor, such as a spouse or co-borrower, is another qualifying hardship.

- Divorce or Legal Separation: A divorce or separation that disrupts your household’s financial stability can make you eligible.

- Natural Disasters: Damage from events like hurricanes, floods, or wildfires – particularly those declared as major disasters by the President – may qualify.

- Military Duty: Being called to active duty can also be considered a hardship.

| Hardship Type | Documentation Needed |

|---|---|

| Job Loss / Income Reduction | Unemployment statements, pay stubs, or tax returns |

| Medical Hardship | Hospital bills, doctor’s letters, or insurance statements |

| Death of Spouse | Death certificate or legal documentation |

| Natural Disaster | Insurance claims or FEMA assistance documentation |

| Divorce | Divorce decree or legal separation agreement |

Along with the necessary documentation, you’ll need to submit a hardship letter or affidavit that explains your situation in detail. Thanks to updated HUD guidelines effective October 2025, the process for loan modifications has been simplified.

As outlined in HUD Handbook 4000.1: "The Borrower is not required to provide financial documentation to be evaluated for a Loss Mitigation Option. The Mortgagee must not use any financial documentation about the Borrower to disqualify the Borrower from a Loss Mitigation Option other than the required Financial Hardship documentation."

This change allows servicers to focus on verifying your hardship and occupancy status, making it easier for homeowners to seek help while ensuring that the process remains fair and thorough.

How to Apply for an FHA Loan Modification

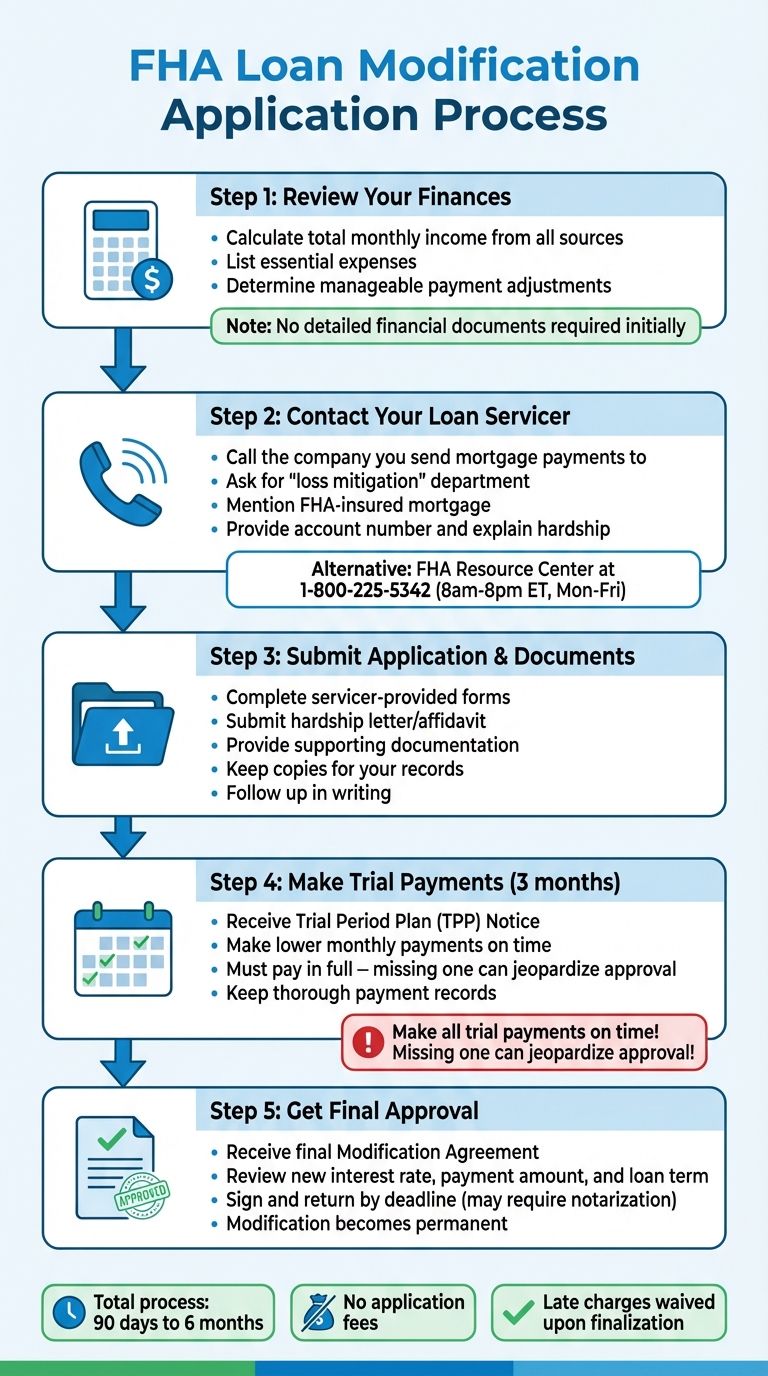

FHA Loan Modification Application Process: 5 Steps to Approval

Once you’ve confirmed your eligibility, it’s time to start the application process for an FHA loan modification. Recent updates to HUD guidelines have made the process more straightforward.

Step 1: Review Your Finances

Take a close look at your current income and expenses before contacting your loan servicer. Figure out your total monthly income from all sources and list your essential expenses. While you won’t need to submit detailed financial documents right away, having this information on hand will help you understand what kind of payment adjustments you can manage.

Step 2: Contact Your Loan Servicer

After organizing your financial information, reach out to your loan servicer. This is the company you send your monthly mortgage payments to, and their contact details can be found on your mortgage statement. When you call, ask to speak with the "loss mitigation" department.

"If you are experiencing a financial hardship that impacts your ability to make your mortgage payments on time, contact your mortgage servicer as soon as possible to discuss your options." – U.S. Department of Housing and Urban Development (HUD)

Be sure to mention that your mortgage is FHA-insured so the servicer applies the correct HUD guidelines. You’ll need to explain your financial hardship and provide your account number. During this conversation, the servicer will explore different loss mitigation options to find the best fit for your situation.

If you’re struggling to connect with your servicer or need extra help, you can contact the FHA Resource Center at 1-800-225-5342 during their business hours (8:00 a.m. to 8:00 p.m. ET, Monday through Friday). You can also seek free assistance from a HUD-approved housing counseling agency.

Step 3: Submit Your Application and Documents

Once you’ve spoken with your servicer, gather and submit the required application documents. Your servicer will provide the forms and specific instructions. Thanks to the simplified process, you won’t need to submit extensive financial records. Instead, the focus is on verifying your financial hardship and confirming the property is your primary residence.

You’ll need to include a hardship letter or affidavit detailing your situation, along with any supporting documents (as outlined earlier). Make sure your submission is complete, keep copies for your records, and follow up in writing to confirm what was discussed.

Step 4: Make Trial Payments

If your application is approved, you’ll typically enter a three-month trial payment period. Your servicer will send you a Trial Period Plan (TPP) Notice, which will outline your new monthly payment, the first due date, and the deadline for accepting the terms.

These trial payments are usually lower than your original mortgage payments and are designed to show that you can handle the adjusted terms. It’s critical to make these payments on time and in full, as missing even one could jeopardize your approval.

"If asked to do so, it’s obviously very important that you make these payments in full and on time." – Jim Akin, Experian

Keep thorough records of all trial payments as proof of compliance. This trial phase is essentially the last step before your modification becomes permanent.

Step 5: Get Approval and Review Final Terms

After completing the trial period successfully, your servicer will send you a final Modification Agreement. This document will detail the permanent terms of your modified loan, such as the new interest rate, payment amount, and loan term.

Take the time to carefully review the agreement and ensure it matches what was discussed. Make sure you understand any changes to your loan balance or payment structure. Some agreements may require notarization, so check if this applies to your case.

"After a successful trial period, you’ll sign new documents and the modification will become permanent." – Zev Freidus, President, ZFC Real Estate

Once you sign and return the agreement by the deadline, your modification becomes official. The entire process typically takes 90 days to six months from start to finish. There are no fees to apply for an FHA loan modification, and any unpaid late charges are usually waived once the modification is finalized.

FHA Loan Modification Options and What They Offer

Types of Modifications Available

Under the FHA loss mitigation framework, your loan servicer reviews your eligibility for various options, starting with the least disruptive solutions before escalating to more involved modifications. The aim is to match the option to your financial circumstances while helping you stay in your home.

Standalone Loan Modification adjusts your mortgage terms permanently. This often involves lowering your interest rate and/or extending your repayment period to 30 or even 40 years. Any overdue amounts are added to your principal balance and spread across the new loan term. This option is ideal for borrowers who have experienced a lasting reduction in income and need lower monthly payments.

Standalone Partial Claim tackles delinquency without changing your original loan terms. HUD provides an interest-free loan to cover up to 30% of your unpaid principal balance, bringing your mortgage current. This loan becomes a subordinate lien, repayable only when you sell, refinance, or pay off your mortgage. It’s a good fit if you can resume regular payments but need help catching up on missed ones.

Payment Supplement is aimed at borrowers struggling with high monthly payments, especially in an environment of high interest rates. It uses partial claim funds to temporarily reduce your principal and interest payments by 5% to 25% for up to 36 months, without altering your original interest rate. This option works well if your current rate is favorable but your payments are still too high.

Combination Option blends a loan modification with a partial claim. This approach provides immediate relief for overdue payments and permanently reduces your monthly payments. It helps bring your loan current while restructuring the terms for better long-term affordability.

| Modification Type | How It Works | Payment Impact | Repayment Terms |

|---|---|---|---|

| Standalone Loan Modification | Adjusts interest rate and/or extends term to 40 years | Permanent reduction to principal and interest | Paid over new loan term (30–40 years) |

| Standalone Partial Claim | Interest-free second lien to bring mortgage current | Resumes original payment amount | Due at sale, refinance, or payoff |

| Payment Supplement | Partial claim funds reduce monthly payments temporarily | 5%–25% reduction for 3 years | Subsidized amount due at sale/refinance |

| Combination Option | Combines modification with partial claim | Immediate arrears relief + permanent reduction | Modified first mortgage + subordinate lien |

These options are designed to ease the financial strain by adjusting loan terms and reducing monthly payments.

How Loan Modifications Help Homeowners

Each modification option offers a tailored approach to reduce monthly payments and stop foreclosure proceedings. FHA modifications often lower monthly payments by 20% to 25%, aligning them with your current income. This reduction can be the difference between keeping your home and losing it.

Another key benefit is that modifications halt the foreclosure process. By providing a structured way to bring your mortgage current, they give you breathing room to stabilize your finances. Once you complete your trial payment plan, foreclosure proceedings are paused, allowing you to focus on recovery. Overdue amounts, including interest and escrow, are typically addressed through capitalization or a partial claim.

"A Loan Modification is a permanent change to one or more terms of your mortgage. The modification resolves the past due mortgage payments by adding [past due] amount to the principal loan balance… and extending the term." – HUD

These modifications also provide housing security. Whether through permanent restructuring or temporary payment relief – like the Payment Supplement – you gain a manageable payment plan. The Partial Claim, with its interest-free assistance and repayment deferred until you sell or refinance, offers added flexibility.

How Foreclosure Defense Group Can Help

Legal Services for Loan Modifications

Foreclosure Defense Group provides legal guidance to ensure loan servicers comply with HUD’s required procedures, offering free consultations to evaluate your FHA loan modification options.

Their attorneys focus on making sure servicers follow HUD’s guidelines. This is crucial because, as attorney Amy Loftsgordon explains, "Many courts have said that a servicer’s failure to comply with HUD guidelines provides a defense to a foreclosure".

In addition to loan modification support, the group offers a range of services, including foreclosure defense, bankruptcy assistance, help with loan forbearance, and advice on deed-in-lieu or short sale solutions. Their goal is to defend homeowners’ rights and create personalized strategies for financial relief. This legal expertise not only simplifies the application process but also strengthens your position against wrongful foreclosure actions.

Benefits of Legal Representation

Legal representation is a key safeguard when navigating the FHA modification process. Attorneys can spot procedural mistakes that courts often recognize as valid foreclosure defenses. They also help you tackle the complexities of FHA regulations, such as the rule allowing only one permanent loss mitigation option within a 24-month period.

Legal professionals are especially helpful when servicers fail to clearly communicate available options or when standard modifications fall short of providing adequate relief. They can explore alternative solutions, including "outside of the waterfall" loan modifications, and assist with newer frameworks like the 2026 Payment Supplement option. Attorneys also guide you through trial payment plans, ensuring all requirements are met for final approval. If keeping your home isn’t possible, they can advise on short sales or deeds-in-lieu to help you avoid deficiency judgments.

Conclusion

FHA loan modifications adjust mortgage terms to make payments more manageable and help homeowners avoid foreclosure. These changes might include lowering interest rates, extending the loan term, or rolling missed payments into the balance. The HUD-mandated waterfall process ensures loan servicers explore all loss mitigation options before considering foreclosure, giving homeowners multiple chances to retain their homes.

If you’re at risk of missing a payment, reach out to your loan servicer right away to discuss your options. You can also seek free guidance from HUD-approved housing counselors, who can help you navigate the process and organize your finances.

Legal assistance is another resource to consider. Attorneys can help protect your rights by identifying any violations of HUD guidelines by loan servicers. Courts often recognize these violations as valid defenses against foreclosure. Additionally, legal professionals can help you understand complex rules, like the restriction limiting borrowers to one permanent loss mitigation option every 24 months.

Don’t wait for foreclosure proceedings to begin. Contact your loan servicer, a HUD-approved counselor, or organizations like Foreclosure Defense Group as soon as possible. Foreclosure Defense Group offers free consultations to assess your situation and create a tailored plan to help you keep your home.

Take action now to protect your home and secure your future.

FAQs

What can I do if my FHA loan modification request is denied?

If your FHA loan modification request is denied, the first step is to carefully review the denial letter. This document will outline the reasons for the decision, helping you understand what went wrong. Once you have this information, reach out to your mortgage servicer as soon as possible. Discuss the reasons for the denial and ask about other options that might be available, such as repayment plans, forbearance agreements, or partial claims. If your financial situation improves, you might also have the chance to reapply for a loan modification.

It’s also wise to consult with a legal professional who specializes in foreclosure defense. Experts, like those at Foreclosure Defense Group, can guide you through your options, including assistance with loan modifications, bankruptcy, or deed-in-lieu solutions. Time is of the essence – acting quickly can make a significant difference in protecting your home and finding a workable resolution.

How does the Payment Supplement option impact my mortgage balance over time?

The Payment Supplement option offers a way for homeowners to temporarily lower their monthly mortgage payments. It works by using a partial claim to bring your mortgage up to date and provides a monthly principal reduction for up to three years. This can ease financial strain and make managing payments more straightforward during that time.

That said, it’s crucial to understand what happens after the temporary reduction period ends. The deferred amount might be added back to your total mortgage balance, which could increase the amount you owe overall. While this option can help you avoid foreclosure in the short term, it’s essential to carefully review your specific terms and consult a financial professional to fully understand how it may impact your long-term financial outlook.

Can I get another FHA loan modification if I’ve already had one in the last two years?

Yes, it’s possible to apply for another FHA loan modification, but there’s a required waiting period of at least 24 months from the date of your last modification or partial claim. This gap is intended to give borrowers enough time to work on stabilizing their finances before seeking further assistance.

If you’re uncertain about your eligibility or need help with the process, it might be a good idea to consult with professionals who focus on foreclosure defense and loan modifications. They can offer advice specific to your situation and help you take the right steps to safeguard your home.

Related Blog Posts

- Government Loan Modifications: Solving Foreclosure Risks

- Checklist: FHA Foreclosure Relief Eligibility

- Top Legal Cases on Loan Modification Breaches

- Loan Modification Compliance: Legal Rights Explained