Loan modification compliance is about ensuring fair treatment for homeowners facing foreclosure. Federal laws, primarily under Regulation X of RESPA, set clear rules mortgage servicers must follow to process applications fairly. These protections can prevent foreclosure if followed correctly, but servicers often fail to comply, leaving borrowers vulnerable.

Here’s what you need to know:

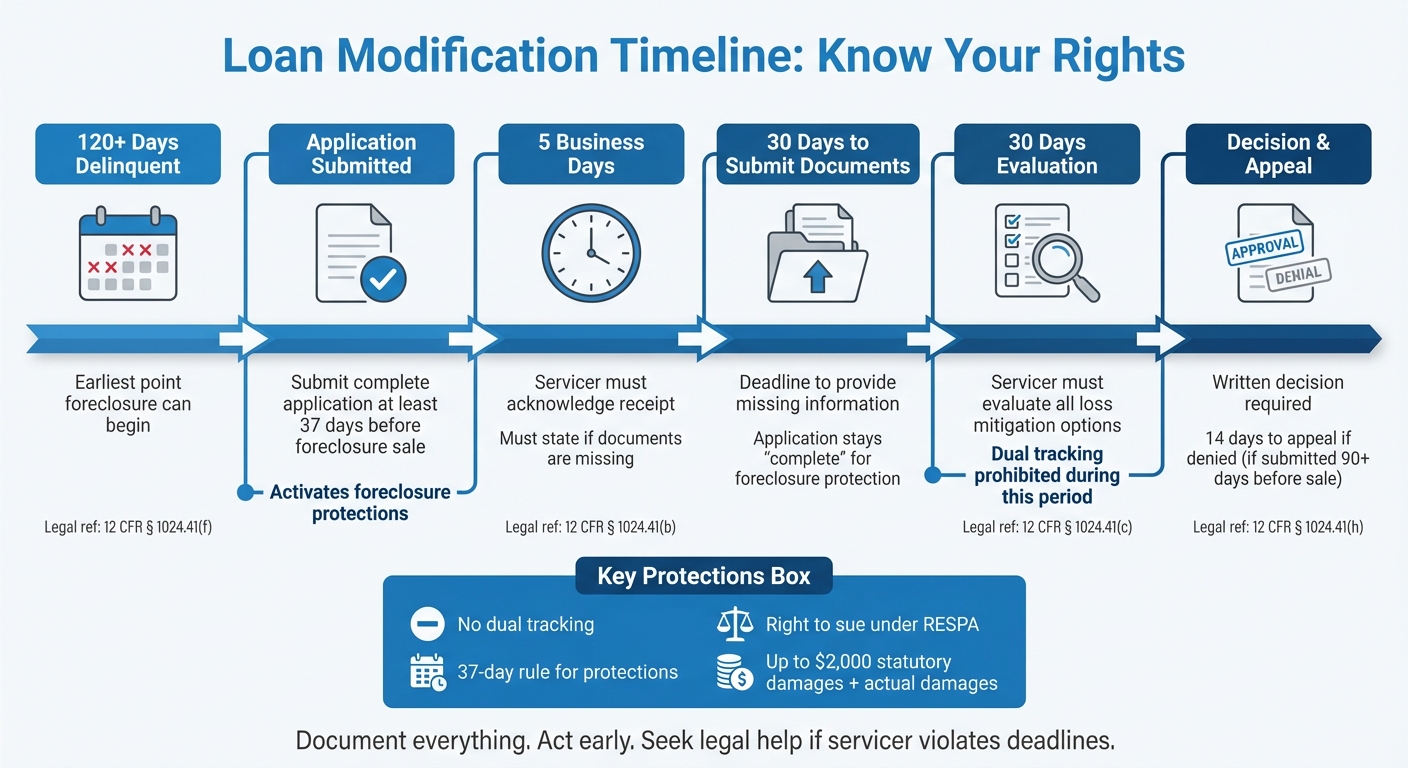

- Foreclosure can’t start unless you’re 120+ days behind on payments.

- Servicers must review complete applications within 30 days (if submitted at least 37 days before a foreclosure sale).

- You can appeal a denial if your application is submitted 90+ days before the sale.

- Dual tracking is prohibited – servicers can’t pursue foreclosure while reviewing your application.

While laws protect borrowers, servicers often delay or mishandle applications, leading to wrongful foreclosures. If you notice violations like repeated document requests or foreclosure actions during application reviews, legal recourse is available. Borrowers can sue for damages under RESPA or use violations as a defense in foreclosure cases.

Takeaway: Document everything, act early, and seek legal help if needed to protect your rights.

Loan Modification Timeline: Federal Requirements and Key Deadlines

1. Federal Legal Requirements for Loan Modification Compliance

Timely Acknowledgment and Evaluation

Under Regulation X of RESPA, servicers must adhere to strict timelines when processing a loss mitigation application. Within 5 business days of receiving your application, they are required to send a written acknowledgment stating whether additional documents are needed. If anything is missing, the servicer must clearly outline what is required and provide a reasonable deadline – usually 30 days – for you to submit the documents. Once your application is complete and submitted at least 37 days before a foreclosure sale, the servicer has 30 days to evaluate your eligibility for all available loss mitigation options. During this process, servicers must actively gather any necessary documents.

| Requirement | Timeline | Legal Reference |

|---|---|---|

| Written Acknowledgment | 5 Business Days | 12 CFR § 1024.41(b) |

| Complete Application Evaluation | 30 Days | 12 CFR § 1024.41(c) |

| Earliest Foreclosure Referral | 120+ Days Delinquent | 12 CFR § 1024.41(f) |

| Appeal of Denial | 14 Days | 12 CFR § 1024.41(h) |

Application Handling and Documentation

An application is considered complete once all requested documents are submitted. This designation is crucial because it activates foreclosure protections, even if the servicer later identifies additional information they need. If further documents are requested after the application is marked as complete, the servicer must still treat it as complete for foreclosure protection purposes while you provide the additional information.

Federal law also prevents servicers from rejecting your application due to missing information that is outside your control – such as a credit report or property appraisal – provided they have made reasonable efforts to obtain it. A complete application includes all the information the servicer needs to assess your eligibility for loss mitigation options.

Failure to follow these procedures not only delays the evaluation process but also strengthens your legal position.

Borrower Recourse for Violations

If servicers fail to comply with these rules, borrowers have strong legal options. Under Section 6(f) of RESPA (12 U.S.C. 2605(f)), you have the right to sue for damages caused by violations of Regulation X. The regulation explicitly states:

"A borrower may enforce the provisions of this section pursuant to section 6(f) of RESPA (12 U.S.C. 2605(f))."

Additionally, violations can be used as a defense in foreclosure proceedings. For example, initiating foreclosure while a complete application is pending is a direct violation of federal law. However, it’s important to note that federal law doesn’t require servicers to offer specific loss mitigation options, nor does it allow you to enforce agreements between the servicer and the loan owner. To protect your rights, document all interactions with your servicer and consult a foreclosure attorney if you suspect any violations.

2. How Servicers Actually Handle Loan Modifications

Timely Acknowledgment and Evaluation

Federal law sets clear rules: servicers must acknowledge receiving a loss mitigation application within five business days. But in reality, things don’t always run so smoothly. Many borrowers face repeated requests for documents, which can drag out the process. Each new request for missing items restarts the 30-day evaluation clock, making the wait even longer. Plus, documents like pay stubs and bank statements can expire during the review period, forcing borrowers to resubmit paperwork they’ve already provided.

Application Handling and Documentation

Sometimes, servicers flag applications as incomplete for minor issues – like a missing page in a document packet. And mistakes can have devastating consequences. For instance, in 2018, Wells Fargo revealed that a computer glitch wrongly denied loan modifications to about 870 qualified borrowers. Tragically, this error led to the foreclosure of 545 homes.

"Mortgage servicing companies sometimes make serious errors when processing loan modification requests. These mistakes can cause many problems for a homeowner, like missing out on getting the loan modified or even a wrongful foreclosure."

– Amy Loftsgordon, Attorney, Nolo

Communication breakdowns only add to the frustration. Borrowers often receive incorrect guidance, like being told they must default on their loan to qualify for a modification. In other cases, servicers fail to notify borrowers about missing documents in a timely manner. The situation worsens when loans are transferred to a new servicer – applications and trial modifications can get lost entirely, forcing borrowers to start over from scratch. These errors often play a key role in defending against foreclosure.

Borrower Recourse for Violations

When servicers stray from federal guidelines, borrowers aren’t without options. For example, some servicers still pursue foreclosure even while a loan modification application is under review – a practice that federal law prohibits. Borrowers can file complaints with the CFPB, which typically responds within 15 days, or seek help from organizations like the Foreclosure Defense Group to protect their rights. These violations can also be used as a legal argument to pause or stop foreclosure proceedings.

Loan Modification Denied! Foreclosure emergency. What can you do?

sbb-itb-d613a70

Pros and Cons

Federal law offers protections to homeowners seeking loan modifications, but the way servicers handle these cases often leaves gaps. Here’s a closer look at where legal safeguards meet the challenges of real-world practices:

| Aspect | Federal Legal Protections | Common Servicer Practices | Real-World Impact |

|---|---|---|---|

| Foreclosure Prevention | Federal law prohibits dual tracking, meaning foreclosure proceedings can’t continue while a complete loss mitigation application is under review (if submitted more than 37 days before the sale). | Miscommunications within servicer teams sometimes allow foreclosure sales to proceed despite the ban. | Borrowers face unnecessary stress and a higher risk of losing their homes. |

| Timeline Guarantees | Servicers must acknowledge complete applications within 5 business days and provide a written decision within 30 days. | Servicers often restart the evaluation period by repeatedly requesting the same documents. | These delays can lead to prolonged delinquencies, compounding fees, and interest. |

| Legal Recourse | The Real Estate Settlement Procedures Act (RESPA) gives borrowers the right to recover actual damages, attorney fees, and up to $2,000 in statutory damages. | Pursuing legal action requires time, thorough documentation, and legal representation. | While this provides leverage, homeowners may face significant hurdles enforcing their rights. |

| Servicing Transfers | New servicers must honor existing timelines and pending applications when loans are transferred. | Records like application materials and trial payments are often lost or mishandled during transfers. | Borrowers may need to restart the process, losing valuable time. |

| Evaluation Standards | Servicers must exercise reasonable diligence and offer an independent appeal if a modification is denied. | Decisions often remain at the servicer’s discretion, with no obligation to offer specific options. | Borrowers are assured a fair review but may still face rejection, even if they meet financial qualifications. |

The 120-day pre-foreclosure period ensures homeowners have at least four months to explore loss mitigation options before foreclosure proceedings can begin. However, servicers’ interpretations of "delinquency" – such as rolling delinquencies – can complicate this timeline.

Foreclosure Defense Group specializes in helping homeowners enforce their rights and address servicer violations.

"When a mortgage servicer fails to comply with the requirements under the new rule, the borrower has a private right of action under RESPA for out of pocket and emotional distress damages, attorney fees, plus up to $2000 in statutory damages."

– Sarah Bolling Mancini and John Rao, Attorneys, National Consumer Law Center

Federal protections are only as effective as the homeowner’s diligence. Tracking applications, documenting all interactions, and acting swiftly when servicers fall short are key to navigating these challenges.

Conclusion

Federal law lays out clear protections for homeowners navigating the loan modification process. These include the 120-day pre-foreclosure waiting period, restrictions on dual tracking, and specific timelines servicers must follow when responding to borrowers. However, these safeguards are only effective when enforced, and servicer noncompliance remains a common issue. This legal backdrop highlights the real-world hurdles borrowers often face.

Understanding your rights is essential. As attorney Amy Loftsgordon points out:

"If you’re facing a foreclosure, understanding your legal rights can make the difference between saving your home and losing it at a foreclosure sale".

Make it a priority to document every interaction with your servicer. Submit your application at least 37 days before a scheduled foreclosure sale to ensure federal protections apply. If your application is denied, you typically have 14 days to file an appeal.

Be vigilant for warning signs, such as repeated requests for documents you’ve already provided, foreclosure actions moving forward despite a pending application, or records disappearing after a servicing transfer. These issues can bolster any legal claims you may need to make.

If your servicer fails to meet deadlines, ignores notices, or proceeds with foreclosure despite your compliance, it’s crucial to seek legal assistance. The Foreclosure Defense Group offers experienced representation to help you hold servicers accountable throughout the loan modification process.

Take action early – don’t wait until foreclosure is imminent. The sooner you act and the more thorough your documentation, the stronger your case will be. Federal protections are in place, but it’s up to you to ensure they’re enforced.

FAQs

What can I do if my loan servicer doesn’t confirm receipt of my loan modification application within 5 business days?

If your loan servicer hasn’t acknowledged receiving your loan modification application within 5 business days (not counting weekends or holidays), you’re entitled to follow up. Federal rules require servicers to confirm receipt of a loss mitigation application within this window. Start by reaching out to your servicer directly to confirm that they’ve received your application and are processing it.

If they still don’t respond, you can take further steps. Consider filing a formal complaint or seeking advice from a legal professional. A foreclosure defense attorney can help ensure your application gets the attention it deserves and that your servicer follows the law.

How can I show that my loan servicer broke federal loan modification rules?

To prove that your loan servicer violated federal loan modification rules, you’ll need to collect evidence showing they failed to follow the procedures outlined in federal regulations, particularly Regulation X (12 CFR § 1024.41). Common issues include not reviewing or acknowledging a complete loss mitigation application within the required timeframe, neglecting to send written confirmation within five business days, or failing to make reasonable efforts to gather necessary documents.

Recent rule updates also require servicers to meet specific safeguards before initiating foreclosure proceedings. They must also offer streamlined loan modifications when appropriate, especially for homeowners dealing with COVID-19-related hardships. Be sure to keep detailed records of all communications, notices, and timelines to identify any procedural errors. If you believe a violation has occurred, working with an experienced foreclosure defense attorney can help clarify your rights and strengthen your case.

What are my legal options if my loan modification application is mishandled?

If your loan modification application isn’t handled correctly, there are legal steps you can take to defend your rights. For example, if your application is improperly denied or not processed as it should be, you may have the option to file an appeal. Appeals generally need to be submitted within 14 days, and federal guidelines require a different reviewer to assess the appeal and issue a written response within 30 days.

There are also federal rules in place to ensure servicers follow proper procedures for loss mitigation. If a servicer fails to meet these standards or makes serious mistakes, you could file a complaint with regulatory agencies or even take legal action for mishandling your case. Speaking with a qualified legal professional, like those at Foreclosure Defense Group, can provide clarity on your rights and help you decide on the best course of action to protect your home.

Related Blog Posts

- Loan Modification Document Checklist

- Wrongful Foreclosure: Key Legal Rights Explained

- Top Legal Cases on Loan Modification Breaches

- Common Lender Errors in Foreclosure Cases